The start of the New Year is when we traditionally set our personal and professional targets for the 12 months to come.

Many readers will no doubt agree, however, that sticking to resolutions becomes progressively more difficult as the weeks and months elapse.

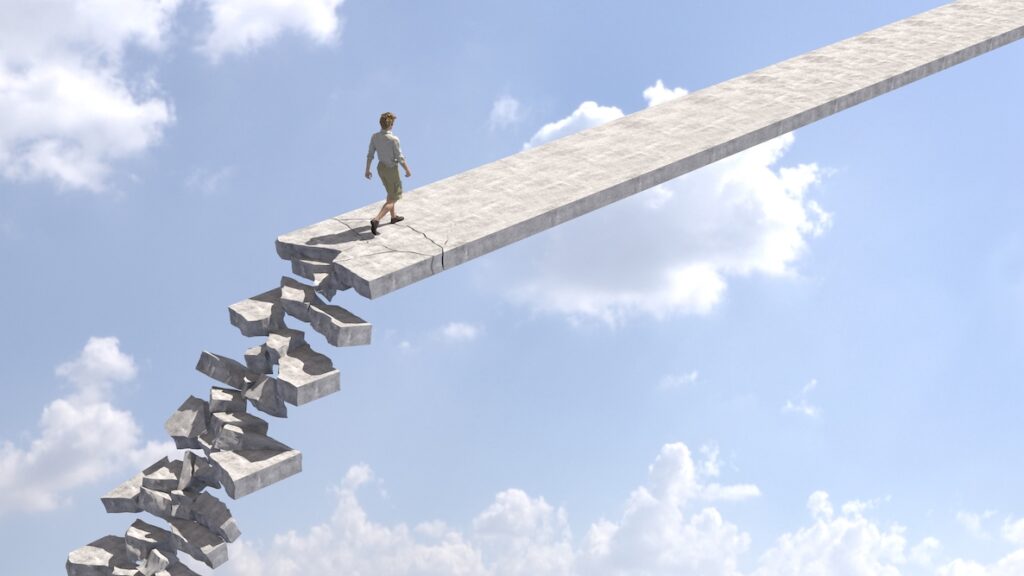

Establishing a strategy is a key ingredient but not the entire recipe for success in itself. What is important is how a company and its preparations copes with the actual challenges placed before it

Or, as the former world heavyweight boxing champion Mike Tyson put it, “everyone has a plan until they get punched in the mouth”.

Whilst I sincerely hope that the threats facing businesses across the country will not involve physical harm, what is certain is that their resolve is likely to be severely put to the test as economic circumstances harden during this year.

It underlines why I believe that a new approach to considering risk should be top of the priorities list for every business in 2023.

I don’t just say that because the Bank of England has predicted the UK is set for a lengthy recession.

Nor is it that financial commentators reckon the impact of such a downturn will be more severe for the UK than for any other country in the G7 group of the world’s leading economies.

Evidence from at home and abroad continues to indicate that despite having fully emerged from lockdown, we have not yet completely escaped Covid-19.

Only last week, the Transport Secretary, Mark Harper, revealed that one-in-45 people in the UK had the virus.

Although there seems little prospect of or desire for any fresh controls being put in place beyond testing of those travelling from those parts of the world which are worst affected, the situation will send a chill down the spines of business owners for whom the darkest days of the 2020 pandemic are still fresh in the memory.

Figures published by the Office for National Statistics (ONS) show that tens of thousands of businesses ceased trading as a result of the acute economic pressures which they experienced during lockdown.

Even allowing for that, the squeeze on corporate finances created by rising energy bills meant that company insolvencies are currently at their highest levels since the last major recession in 2009.

We shouldn’t overlook the growing impact of extreme weather either. It led to £93.5 billion worth of claims last year.

So severe is the challenge which climate change poses that the Association of British Insurers (ABI) has already warned the industry needs to “evolve” in order to be an even more effective part of the response.

All that is also before we take into account the growing threat of cyber attacks which have prompted the Chief Executive of the insurer Zurich to suggest that they may become “uninsurable” in the future.

Now, I don’t necessarily wish to start the New Year in a manner which contrasts with the jollity that we may have become used to over the festive period.

What I do want to insist, though, is that with such a bleak outlook, it benefits companies of all sizes and in all kinds of industries to make the evaluation and management of risk one of their key objectives.

As many sectors discovered during the pandemic, even businesses which are trading well can be derailed by an unforeseen issue which subsequently becomes existential.

Sometimes, business owners only realise that they have an insurance blind spot when a problem occurs and by then it may be too late.

That is part of the role of an insurance broker: engaging in a frank conversation with a client as an objective advisor to understand a company – how it operates and its individual attitude to risk – and ensure that it is adequately protected for all eventualities.

After all, a year is a long time in business.

Written by Daniel Lloyd-John, Chief Executive, Broadway Insurance Brokers